9 services for bitcoin tracking

![]()

In this blog post we have put together a list of blockchain analytics companies with advanced bitcoin tracking capabilities and the power to deanonymize Bitcoin mixers and their clients. This roundup also mentions a couple of similar services providing free blockchain intelligence reports..

The rapid evolution of the cryptocurrency industry continues to hold the attention of governments and regulators worldwide. Cypherpunks’ dream of free and independent payment methods seems be a notion from light years ago. Here and now have to deal with the harsh reality. The regulation of cryptocurrencies is following suit of how the bank industry is being controlled.

No matter how anonymous the use of crypto looks (you do not need an ID to start using digital coins, do you?), the blockchain’s open ledger lures the powers that be into the crypto space where they can scan every money movement or exchange transactions on-chain. By gaining total control over cryptocurrency stock exchanges and fiat-crypto exchange platforms they would untie their hands completely and allow a freer use of sanctions. The massive privacy breach is of course positioned as nothing but good intentions of facilitating Anti-Money Laundering (AML) and Know Your Customer (KYC) initiatives that, for the record, not without their help are becoming a standard internationally.

Chainalysis, one of the leading vendors of KYC solutions for the crypto industry, in their blog post state that the openness of financial data on blockchain comes as a driver for regulatory institutions to reinforce control. With a powerful blockchain analytics tool like Chainalysis, which gives an insight into how and what people spend their crypto holdings on, regulatory bodies could end money laundering, make financial reporting easy and transparent, wouldn’t that be nice? The article mentions a few recent precedents of Asian crypto platforms making a go decision on KYC compliance – it is supposed to relieve them of problems with law enforcement and assist in winning new audiences in the USA and Europe. The message is loud and clear – the regulation for cryptocurrency platforms will grow in 2019.

Bitcoin tracking as a trend

Now more and more cryptocurrency services are integrating with AML/KYC software: Binance cryptocurrency exchange, P2P exchange platform Localbitcoins, payment services like Bitpay and others. This is how it works – an incoming transaction goes through a risk scoring and gets a certain percentage. If it comes from a service in the dark net, the system immediately flags it, shows a high risk score and sends this data over to regulatory agencies in lockstep, just like it is done in the conventional banking system.

Just so you know, the use of smaller exchange platforms doesn’t fix the Bitcoin tracking issue either.

Here is a rundown of an intelligence report by Elliptic – another blockchain analytics giant. Surely everyone followed the hacking scandal during the presidential campaign in 2016 – a group of Russian hackers allegedly cracked the email accounts of Hilary Clinton’s employees and volunteers and stole secret documents. Despite the elaborate precautions like the use of peer-to-peer exchange platforms, multiple conversions into different cryptocurrencies and other measures reportedly taken by the perpetrators, Elliptic simply scanned blockchain and were able to track down the funds which the hackers supposedly had used to purchase the domain, server and other stuff. In 2017 Elliptic co-investigated the hack by ‘Fancy Bear’ and also traced the wallet used by the hackers.

Stock exchanges are not playing hardball yet; they are not blocking transactions with suspicious history but regulators are looking to it. Sadly, blockchain stores all transactions there is, meaning you can be forced to account for some old transactions of yours which happen to have an adverse history. Want proof? Won’t have to go far looking, take the Coinbase story.

If blockchain deanonymization tools were not backed by the government, more likely than not their tech would not be making such great strides now. We have put together a list of 9 players in the regtech market for cryptocurrencies. You will find no government agencies there but you can be sure they are watching you not without interest.

Blockchain intelligence for crypto exchanges and other platforms

1. Elliptic

Elliptic – a UK-based company, one of the biggest providers of blockchain analytics data. Elliptic got on board a lot of stock exchanges and financial institutions by arming them with intelligence tools. Have a look at this amazing animation on the website – hard to misinterpret as it literally says they know a lot more about you that you want them to. The company collaborates with the FBI, SEC, IRS and others.

Here is what they say about their expertise and mission: “Elliptic’s proprietary database links millions of bitcoin addresses to thousands of clear web and dark web entities. We back this up with transparent documented evidence. We have delivered actionable evidence in cases involving international arms trafficking, money laundering, theft, and drug offenses” (source: Elliptic official website).

2. Bitfury Crystal

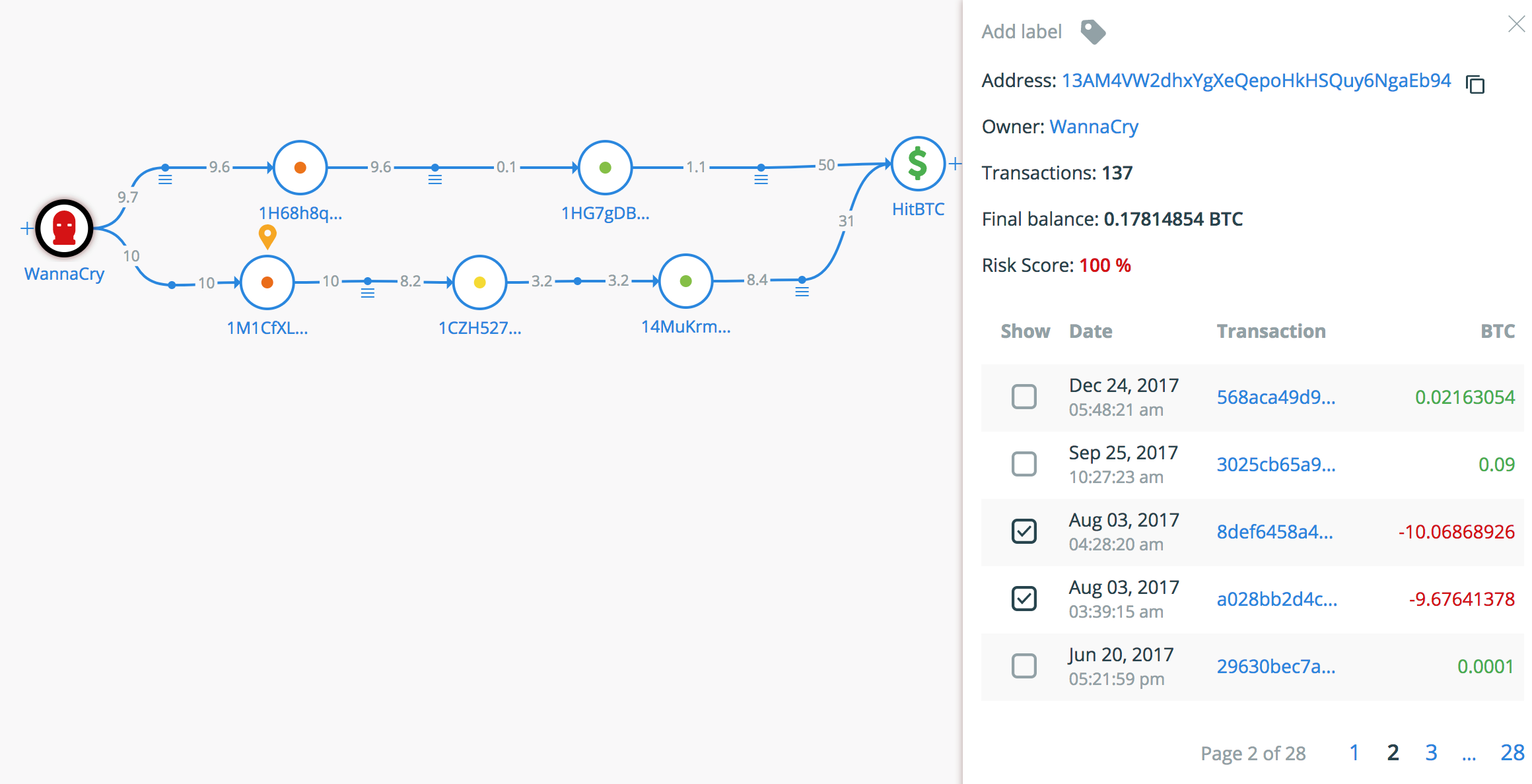

Crystal – is a Bitfury Group product designed to help law enforcement and regulators, as well as any crypto holder by providing them with detailed risk reports on any chosen transaction; the software can visualize the entire history of a given transaction until its final destination.

3. Chainalysis

Chainalysis was one of the first AML/KYC software vendors in the market. The company has developed an investigation software suite with the intention of assisting law enforcement in fighting online illicit activities. They also offer a compliance software suite to cryptocurrency platforms looking to stop bad actors among their users. They capped off the year 2018 with a partnership with Binance that happens to be one of the major cryptocurrency trading platforms. Chainalysis cooperates with the FBI, DEA, IRS.

4. Ciphertrace

Ciphertrace might have a real reason to brag – they do the usual risk-scoring and offer a few regtech solutions but it is their integration with the well-known threat intelligence system by Maltego that sets them apart from the competition. The Maltego employees have a direct access to Ciphertrace’s data for cybercrime investigations. However, their joint product can benefit any crypto user who wants to do their due diligence and check an address, a transaction or a wallet.

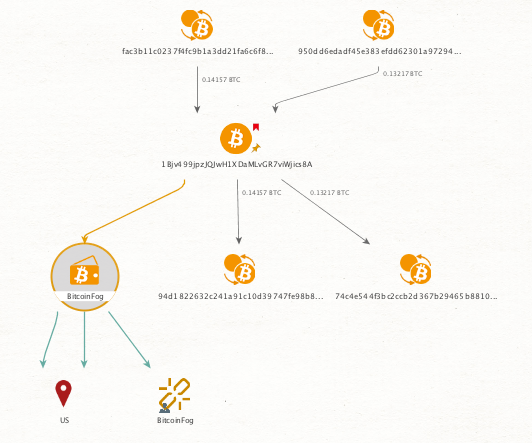

Did you know Ciphertrace are keeping an eye on mixers, too? In their blog post of 19, December they called Bestmixer’s recent marketing campaign a ‘crypto dusting attack’ and accused them of an attempt “to contaminate legitimate users”. A lot of mixers are being watched and it is a good reason for you to start filling yourselves in on the latest technologies that can counter deanonymization attacks. Here is how Ciphertrace deanonymized one of the oldest mixers – BitcoinFog.

Deanonymization of BitcoinFog by Ciphertrace

Ciphertrace algorithms map all possible transaction participants

5. Neutrino

Neutrino – a company whose blockchain intelligence technologies were successfully applied in the deanonymization of the JoinMarket platform in 2016.

6. BIG

Blockchain Intelligence Group – not only do they deliver AML/KYC solutions to regulators and financial institutions but also offer training in cryptocurrency investigation.

Proprietary (non-free) products for Bitcoin tracking

7. Coinfirm

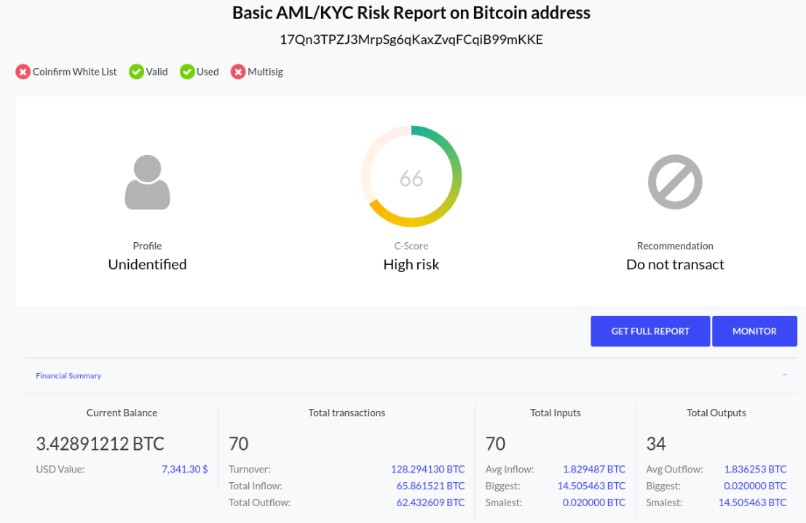

Coinfirm has a product line of 4 regtech solutions: AML и KYC tools, Trudatum for transaction and document authentication through a digital signature, and its own token – AMLT which is rewarded to the members of the AMLT Network for information on suspicious addresses, wallets, etc. Below is a sample risk report by Confirm.

Risk report by Coinfirm

By signing up you can trace all Bitcoin transactions for a chosen address and purchase AML reports starting at $3. P.S. You can pay with crypto.

Free Bitcoin tracking services

8. Walletexplorer

Walletexplorer – a free blockchain analytics portal with the ability to link wallets of different types to crypto platforms. For example, click on Poloniex and you will see Walletexprorer generate a list of the majority of addresses coming from this crypto stock exchange. Just something to think about..

9. Bitinfocharts

Bitinfocharts – a free blockchain explorer tracing addresses back to crypto platforms. For example, here is a list of cold wallets of Bittrex (hit ‘Show addresses in Bittrex-coldwallet’).

- Also read:

- What crippled crypto anonymity in 2018?

- Bitcoin Mixing Market:its beginnings, evolutions and potential

- How does Mixer-money.com work?

Cryptocurrency’s anonymity is nothing but a myth. Very few mixing services can outwit modern deanonymization technologies for Bitcoin tracking. No one has a clear understanding of how fast they regtech will be evolving. There is just one thing beyond question – regulation of the cryptocurrency space will tighten and we all will have to accept the new rules and play by them. This being said, we encourage our clients to go with the ‘Complete anonymity’ mode to make sure your transactions are made clean and resistant to analysis by the latest deanonymization tech.